Navigating the world of car insurance can be confusing, especially when it comes to understanding what makes your premiums go up or down. Familiarizing yourself with these influencing elements empowers you to proactively lower your rates, plan your finances, and even calculate your Ontario premium before buying or renewing a policy.

While some variables—like age and claims history—are outside your control, many others can be actively managed. Customizing your insurance plan and staying updated on industry trends are practical ways to keep costs down while safeguarding your financial well-being.

Every insurance provider weighs risk differently, but certain factors are universally impactful and can significantly affect the amount you pay. That’s why regular policy reviews and comparing multiple quotes are essential, especially as your circumstances evolve.

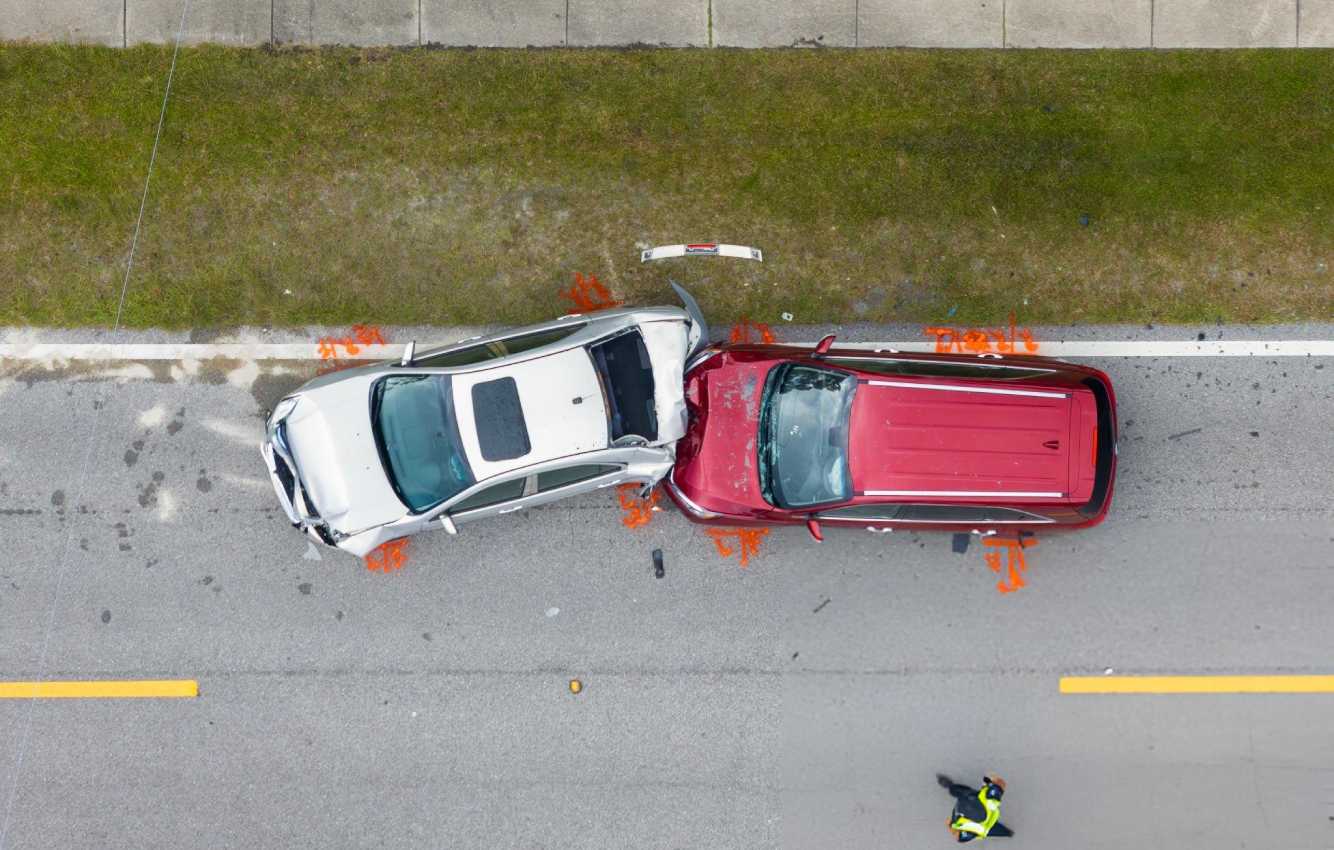

Driving Record

Your driving history plays a significant role in determining insurance premiums. Maintaining a clean record can help you secure lower rates, while incidents such as accidents, traffic violations, or even minor tickets can cause premiums to rise for several years.

Insurance companies consider past behavior a strong indicator of future risk, meaning that even a single speeding ticket could increase your rates by up to 20%. Multiple infractions or serious violations may classify you as a high-risk driver, resulting in significantly higher insurance costs. Being mindful of your driving habits and practicing safe, defensive driving consistently can help protect both your record and your wallet over time.

Age and Experience

Younger drivers, especially teenagers and those under 25, statistically have a higher incidence of accidents, making them riskier to insure. This results in higher premiums regardless of how clean their record is. As you gain experience and maintain a good driving record, your rates generally decrease with age. However, drivers over 65 may also experience gradual increases, as insurers consider factors such as slower reaction times and specific health conditions associated with aging.

Vehicle Type and Features

The type of vehicle you drive has a significant impact on your insurance premiums. High-end cars, luxury SUVs, and sports cars typically cost more to insure because repairs and replacement parts are more expensive. On the other hand, advanced technology and modern safety features can sometimes help lower premiums by reducing the risk of accidents. However, these same features may increase repair costs if damage were to occur.

Family sedans or vehicles with strong safety ratings generally benefit from lower insurance rates. At the same time, models that are more prone to theft or are known for costly repairs tend to carry higher premiums. Considering both the safety features and potential repair expenses of a vehicle can help you make a more informed decision when selecting coverage.

Location

Your location greatly impacts your insurance premium. Urban areas usually have higher rates because of more accidents, denser populations, and increased theft or vandalism. Conversely, rural or small towns often have lower premiums due to less traffic and crime. Additionally, regions susceptible to severe weather or flooding may see elevated rates to cover the higher risk of damage.

Credit Score

In many provinces and regions, insurance companies consider your credit score when assessing risk—higher scores often lead to lower premiums because financially stable individuals are seen as less likely to file claims. However, several provinces limit or prohibit the use of credit scores for determining insurance rates, so it’s wise to check your local rules before shopping for coverage.

Coverage and Deductibles

Finding the right balance between coverage and deductibles is crucial to managing insurance costs effectively. Comprehensive plans often come with higher monthly premiums, and choosing a lower deductible can raise your cost per claim. To avoid overpaying, it’s essential to tailor your policy to your specific needs. Conducting annual policy reviews helps ensure your coverage stays aligned with your current situation and budget, especially after significant life changes, such as paying off a car loan or accounting for vehicle depreciation.

Annual Mileage

The more you drive, the higher your risk of accidents. If your annual mileage is lower—such as when you work from home, have a short commute, or often use public transit—you might qualify for discounts with certain insurers. Remember to inform your provider of any major changes in your driving habits.

Marital Status

Married drivers tend to pay less for car insurance. Statistically, married couples have fewer accidents and are considered more financially stable, which reduces their risk profile in the eyes of carriers. You may also qualify for discounts when bundling multiple vehicles or policies within a household.

Conclusion

The variables that shape your car insurance rates may seem complex, but understanding them allows you to take targeted steps to save money. Maintain a clean driving record, choose a vehicle that fits your needs and budget, and review your insurance policy regularly. Being proactive and well-informed not only protects your vehicle but can also save you hundreds of dollars each year.