Life can be unpredictable, with everyday incidents like slips or pet accidents leading to expensive bills. Personal liability insurance offers protection if you’re legally responsible for injuries or property damage. Many people believe their standard policies are sufficient, but gaps in coverage and rising legal costs can be costly. Even a single incident might threaten your savings.

Knowing how liability insurance works is key to protecting your finances. Claims are growing in frequency and size, making proactive coverage more important than ever. Remember, liability insurance not only gives peace of mind but also safeguards your financial future. Ensure your coverage is sufficient for you and your loved ones.

Understanding Personal Liability Insurance

Protecting yourself from financial loss is an integral part of responsible planning, especially when unexpected accidents or claims occur. Personal liability coverage helps shield you from expenses related to injuries or property damage for which you may be held legally responsible. It can cover legal fees, settlements, and other costs that might otherwise come out of your pocket, offering peace of mind in everyday life.

This type of protection is often included in homeowners, renters, or umbrella insurance policies, making it a versatile safeguard for individuals and families alike. To better understand how this coverage fits your needs and what options are available, learn more from trusted insurance providers or financial advisors before making a decision. Taking time to review your policy limits and coverage details ensures you’re fully protected in case of unforeseen events.

Common Scenarios Covered by Personal Liability Insurance

- Slip and Fall Accidents: When a guest slips on an icy walkway or trips over a loose rug, resulting injuries and their associated costs—medical bills, physical therapy, and even legal claims—can be paid by your liability policy.

- Dog Bites: Even the most friendly pets can unexpectedly bite or injure visitors. If your pet injures someone, your insurance can help cover their medical treatment and any resulting legal settlements.

- Property Damage: Children at play can inadvertently break a neighbor’s window, or you might accidentally damage someone’s property. Personal liability coverage helps pay for repairs or replacements in such cases.

These events are common and can happen to anyone, underscoring the need for comprehensive coverage that addresses a range of risks, both at home and beyond.

Limitations of Standard Insurance Policies

Typical homeowners and auto insurance policies include some liability protection, but these limits are often insufficient for today’s risks. If you’re found liable for a claim that exceeds your coverage—such as a lawsuit following a severe injury—you’re responsible for the excess amount. For example, if your policy limit is $300,000 and you must pay a $600,000 settlement, you would have to cover the remaining $300,000 yourself, potentially putting your personal assets at risk.

This type of gap in protection can have lasting consequences for your financial well-being. The cost of legal defense alone can be overwhelming, and medical expenses continue to rise every year.

The Role of Umbrella Insurance

Umbrella insurance acts as additional protection that sits on top of your existing coverage. When a claim exceeds the limits of your home or auto insurance, an umbrella policy covers the difference. For instance, if your homeowners’ insurance pays out $500,000 on a lawsuit but the total damages are $1.5 million, an umbrella policy can step in to cover the outstanding $1 million.

Given the rising tide of costly liability claims, umbrella insurance is more important than ever for individuals with significant assets or higher-than-average risk exposures. Recent data highlights that bodily injury payouts have risen sharply—up 66% in some regions since the pandemic—which demonstrates why policyholders should not rely solely on standard policy limits.

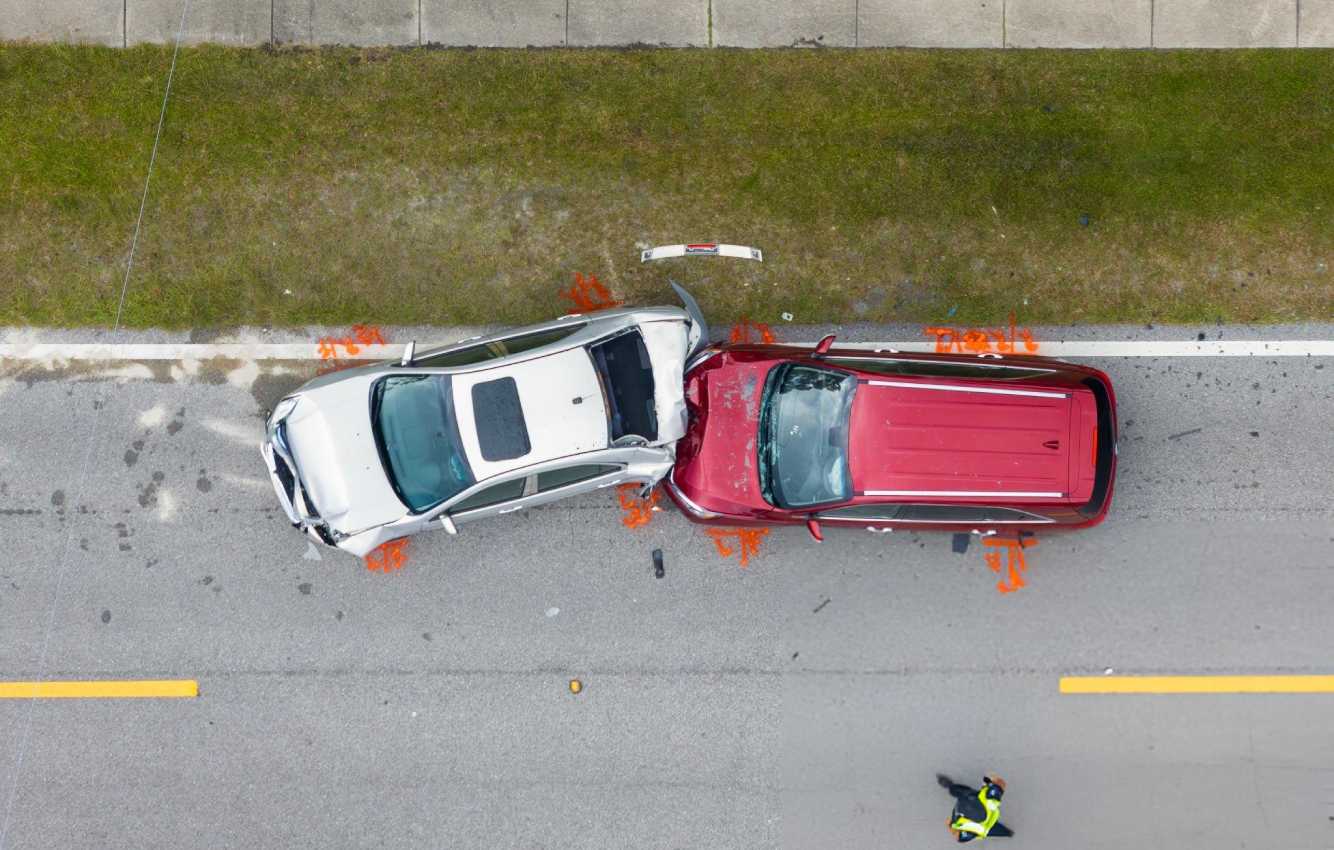

Real-Life Examples of Personal Liability Claims

Illustrating the seriousness of liability claims, one homeowner faced a lawsuit after their dog bit a delivery driver, resulting in a settlement that far exceeded their home insurance coverage. Without umbrella insurance, they had to liquidate a significant portion of their savings to pay the balance, causing real economic and emotional hardship.

Similarly, families with swimming pools or those with frequent guests are often exposed to an elevated risk. One pool owner was held responsible when a child was injured while playing at a summer barbecue. The liability claim—once legal fees and medical treatments were counted—climbed above the family’s policy limits, forcing them to refinance their home.

Tips for Choosing the Right Coverage

- Assess Your Risk Exposure: Do you frequently entertain guests, own pets, or maintain recreational equipment such as trampolines or pools? These factors increase the likelihood of a liability claim.

- Evaluate Your Assets: Your insurance should be enough to shield everything you own, from homes to retirement accounts and future earnings.

- Review Policy Exclusions: Not all situations are covered; therefore, check your policy for specific exclusions or limits, such as those for certain breeds of pets, specific business activities, or intentional acts.

- Consider Umbrella Insurance: If your assets exceed your current coverage or you have high-liability risks, umbrella insurance offers a cost-effective way to add significant protection and peace of mind.

Conclusion

Personal liability insurance is an integral part of comprehensive financial planning and an often-overlooked means of shielding yourself from life’s unpredictable events. With increased awareness of your risk exposure, careful assessment of your policy limits, and the addition of umbrella coverage where necessary, you can minimize the impact of liability claims and avoid devastating financial setbacks. Reviewing your insurance options regularly ensures that your safety net keeps pace with your evolving life circumstances and assets.