FintechZoom is an online portal leading in business news that focuses on high-level analytical coverage of everything regarding financial issues. The importance of this website is that it provides heavy analytic coverage concerning the FintechZoom IBM Stock on Brightreads.

Being an innovation leader and consultant around the globe, IBM has been able to develop its performance by luring investors with good financial backgrounds for many years. FintechZoom provides an in-depth analysis of IBM’s stock movements, financial stability, and market trends so that investors cannot remain ignorant of these situations.

With real-time updates and in-depth reports from experts, you are well-equipped to make informed investment decisions regarding FintechZoom IBM Stock. Whether you are a seasoned investor or just entering the world of stock, FintechZoom’s complete coverage of IBM stocks will guide you through your financial journey.

What Is IBM Stock?

IBM stock is the shares issued by International Business Machines Corporation, a global leader in developing technology and consulting services. IBM HQ is in Armonk, New York, having been established in 1911. It is a large computer hardware and software development company. IBM’s investments of interest include cloud computing, artificial intelligence, and consulting.

History Of International Business Machines Corporation (IBM)

IBM is one such company that goes back its history to 1911. When it was formed as the Computing-Tabulating-Recording Company (CTR) after the amalgamation of three manufacturing companies. In 1924, it was again named IBM with the name given by Thomas J. Watson and has since then experienced immense growth and prosperity.

IBM had been pioneering the production of computer technology; by the 1950s, it had released its first commercial computers. The company went even further in transforming corporate performance with such products as the IBM System/360 in the 1960s. Its influence didn’t end there – in 1981 it released the personal computer, PC, and the game rules changed forever.

Key Competitors Of IBM Stock

IBM is very heavily competing in many sectors, especially in cloud computing, software, and IT services. The major competitors of the company are industry giants who dominate markets similar to theirs. Major competitors of IBM are:

- Microsoft

- Amazon Web Services (AWS)

- Google (Alphabet)

- Oracle

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- SAP

- Accenture

- Cisco Systems

- Salesforce

IBM Stock Performance

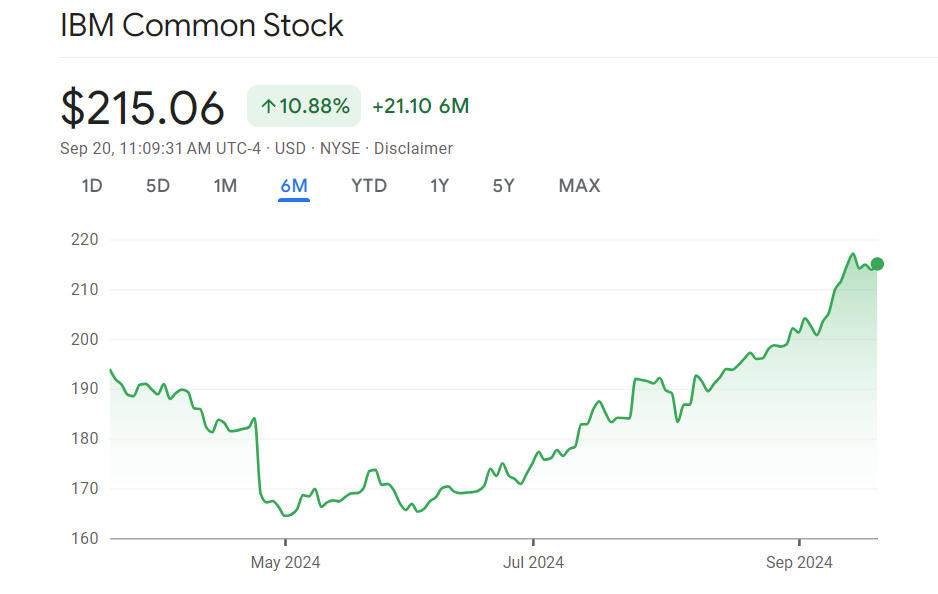

IBM stock has been great for 2024 so far with good financial health and strong growth. During its second quarter, the company reported $15.8 billion in revenue, increasing by 2% year over year and with adjusted EPS of $2.43 up by 11% year over year.

This growth was influenced by significant contributions from both software and infrastructure, with FintechZoom IBM Stock rising by 11.91% in the last quarter and 30.45% year-to-date. This can be seen as an incentive for the investments since investors have responded positively to IBM’s trends in developments of cloud computing and artificial intelligence, among others, as well as strategic buys such as Red Hat, which strengthens its position.

Benefits Of Investing In IBM Stock

Here are some key benefits of investing in FintechZoom IBM Stock on Brightreads :

- Strong Financial Performance: IBM is showing solid financial health with the company posting a 2% year-over-year revenue growth to $15.8 billion and an 11% increase in its bottom line, as EPS rose to $2.43, driven by contributions from the firm’s software and infrastructure segments.

- Consistent Dividends: IBM is also famous for reliable dividend payments, thus providing a stable flow of income that can appeal to income-hunting investors in search of stable returns.

- Market Leadership: The competitive positioning is strengthened by the IBM brand, which had been a leader in innovations of the past and now with Red Hat acquisition in the offing.

- Diversified Operations: The diversified business model of IBM on broad lines of cloud computing, AI, and enterprise consulting brings down the risk and stability.

- Strategic Acquisitions: IBM’s acquisitions, particularly Red Hat, enhance its capacities on cloud and software products that augur well for the market standing and growth potential.

Risk And Challenges Of Investing In IBM Stock

Here are some key risks and challenges of investing in IBM stock:

- Market Volatility: Inverse price fluctuations are due to financial crises, political changes, and investor psychology in IBM shares.

- Aggressive Competition: The threat of expansion and market share of IBM due to Microsoft, Amazon, and Google influences price pressures.

- Technological Disruption: Rapid change requires constant updating. Delayed introduction of new technology might lead to potential obsolescence and income loss.

- Dependence on Major Markets: IBM is heavily dependent on cloud computing, AI, and enterprise consulting; any decline in these segments impacts earnings.

Investing in IBM is perceived as a good opportunity for stability and growth in the innovation sector. This blue-chip stock has a reputation for regularly paying dividend amounts, hence being a true haven for income-focused investors.

Commitment to innovation through cloud computing, artificial intelligence, and quantum computing, along with strategic acquisitions such as Red Hat, enhances the company’s market position and growth potential. Recent financial performance has shown robust revenue and profit growth, which certainly speaks well to investors’ minds and sustains a positive outlook on FintechZoom IBM Stock on Brightreads.

But investors have to also watch the negative factors such as market instability and competition. In total, fundamentals are really strong in IBM and they underpin the good investment opportunity with long-term capital appreciation.