You filed for bankruptcy. It feels like a dead end.

And in many ways, it is.

But not all of them…

Bankruptcy actually offers a fresh start. A second chance. And with the right strategy, financial stability is possible.

In fact, it’s inevitable.

The U.S. Courts just reported a 13.1% spike in bankruptcies during the 12-month period ending March 2025. That’s the largest increase over the prior year in over two decades.

The data shows that more people than ever are turning to bankruptcy to dig themselves out from crushing debt.

But what happens next?

In This Guide:

- Understanding What Just Happened

- Why Credit Scores Drop (And How Fast They Recover)

- 5 Steps to Rebuild Financial Stability

- Avoiding Common Post-Bankruptcy Mistakes

Understanding What Just Happened

Asking for bankruptcy protection is a powerful step.

Just knowing about bankruptcy and garnishment laws is half the battle. When someone files bankruptcy and garnishment, creditors have to stop collection attempts. Wage garnishments end. Phone calls stop. This applies whether someone files for Chapter 7 Bankruptcy or Chapter 13.

It’s a miracle really.

Chapter 7 often discharges most debts in a matter of months. Chapter 13 establishes a 3-5 year repayment plan. Either way, the constant stream of demands finally stops.

Here’s what most people don’t realise though…

The difficult work starts AFTER the discharge.

Building credit and financial stability takes action. It takes discipline. It takes a plan.

Why Credit Scores Drop (And How Fast They Recover)

Let’s get numerical.

Credit scores will drop after filing for bankruptcy. By how much? 130-200 points, on average, depending on where you started. A score of 680 might drop to 530. A 780 could take a nose dive all the way down to 540.

Wow.

The good news is it starts bouncing back almost immediately. According to a study by LendingTree, average credit scores increased 69 points just one month after filing. That’s because debt-to-credit ratios immediately improve once debts are discharged.

Beyond the first month, a typical credit score recovery timeline looks like this:

- 12-18 months: Most people move from poor to fair credit

- 2-4 years: Responsible credit use can push scores over 700

- 7-10 years: Bankruptcy disappears from credit reports entirely

The bottom line? Credit recovery starts much faster than most people expect. But it requires making smart financial choices consistently.

5 Steps to Rebuild Financial Stability

Okay. Ready to get started?

If so, here are the exact steps that lead to actual financial recovery.

Step 1: Create a Realistic Budget

The journey starts with a budget.

Period.

Track every dollar earned. Track every dollar spent. Identify areas of spending that can be cut. Then follow the plan.

Budgeting software and apps make this easier than ever. But a simple spreadsheet will work just fine. The point is to know EXACTLY where money is going each month.

Avoid going back to bad habits without a budget. It’s a short road to repeating old financial mistakes all over again.

Step 2: Build an Emergency Fund

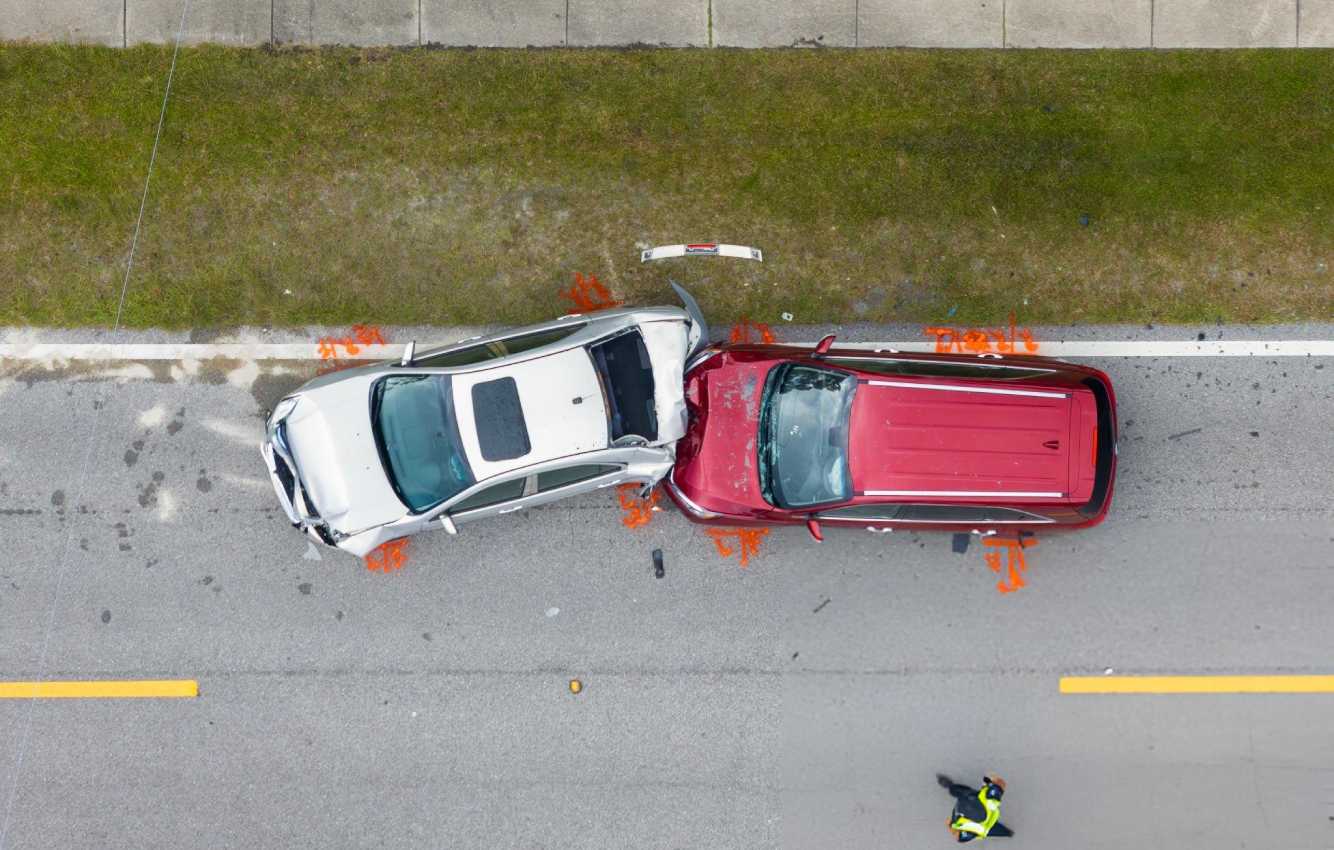

Accidents happen. Emergencies pop up.

Medical bills. Car repairs. Job loss.

Whatever form they take, small emergencies can snowball into major financial disasters. An emergency fund stops them.

Start small. Even saving $500-1000 provides significant protection. Then work towards 3-6 months worth of living expenses.

Keep this money separate from regular checking accounts. Out of sight, out of mind. Only touch it for legitimate emergencies.

Step 3: Open a Secured Credit Card

I know. This one seems backwards. Credit problems usually lead to bankruptcy in the first place, right?

But credit must be used to build credit.

Secured credit cards work like this: Deposit $500 with the card issuer. Receive a credit limit of $500. Use the card for small purchases. Then pay the balance in full every month.

The deposit secures the card. On-time payments every month build positive credit history. Over time, this responsible credit use boosts credit scores.

Keep utilisation below 30% of the credit limit. Never carry a balance on the card. It’s these simple rules that make all the difference.

Step 4: Monitor Credit Reports Regularly

Errors occur. Creditors sometimes report incorrect information. Debts that should be discharged can still show up as delinquent.

Regular credit monitoring catches these issues early.

AnnualCreditReport.com allows everyone to access their free credit reports once per year from Equifax, Experian, and TransUnion. Use this service.

Dispute any mistakes immediately. Incorrect information can unfairly drag down credit scores for no reason. Correcting it is worth the time and effort.

Step 5: Apply for a Credit-Builder Loan

Credit-builder loans work differently from regular loans. The lender holds the loan amount in a savings account while the borrower makes payments. Once the loan is paid off, the borrower receives the funds.

Sounds silly, right?

It works, though. On-time payments get reported to the credit bureaus. This positive payment history shows up on credit reports. That, in turn, drives credit scores higher.

Credit unions and community banks offer these products most often. The interest rates are usually reasonable. Plus, the forced savings is a nice bonus at the end.

Avoiding Common Post-Bankruptcy Mistakes

Roads go smoother when common pitfalls get avoided.

- Taking on too much debt too fast. The availability of credit doesn’t mean it should all be used at once. Start small. Build up slowly.

- Ignoring the budget. The old habits that led to bankruptcy will sneak back if not kept in check. Follow the spending plan no matter what.

- Falling for credit repair scams. Companies claiming to “fix” credit overnight are almost always fraudulent. Legitimate credit rebuilding takes time. No shortcuts.

- Not learning from the experience. Bankruptcy teaches valuable lessons about money management. Those lessons should inform all future financial decisions.

Time Heals (With Help)

One last thing to keep in mind…

The effects of bankruptcy fade with time.

Every year that passes lessens how heavily it gets weighed on credit reports. Lenders start taking less notice of old issues and more notice of recent behaviour.

Chapter 13 bankruptcy stays on credit reports for seven years from the date of filing. Chapter 7 remains for ten years. But long before those records drop off, smart financial habits can offset their impact.

Two to four years after bankruptcy is not uncommon for people to qualify for mortgages. Car loans become available even sooner. It just takes demonstrating that past problems will not repeat.

The Bottom Line

Bankruptcy isn’t the end. It’s a do-over.

Familiarity with bankruptcy and garnishment laws helps make the most of the fresh start that bankruptcy offers. A clear rebuilding strategy makes financial stability achievable.

Budgeting, saving, and responsible credit use are steps on that path. So is patience and consistency. But lots of people have walked this path before and come out stronger at the end.

Time to start walking.